2026 401(k) Contribution Limits: What We Know

Generated Title: 2026 401(k) Boost: Is It Enough to Outrun Inflation?

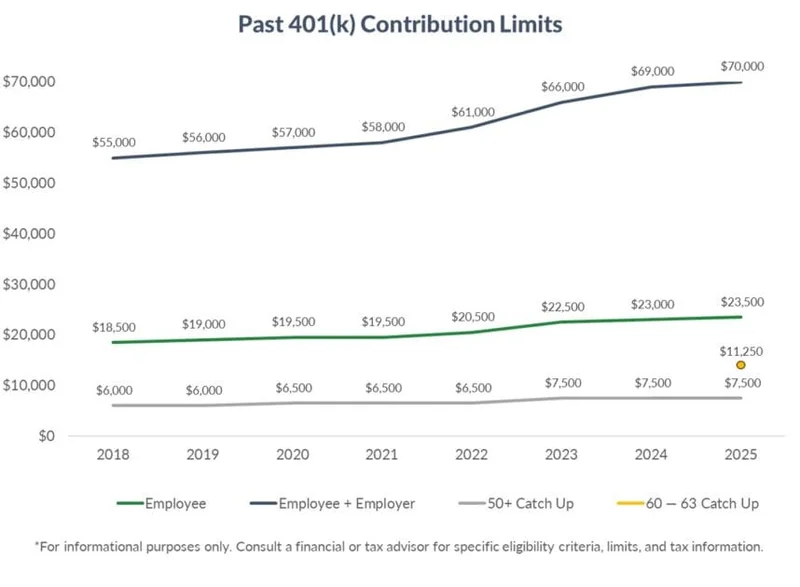

The IRS has announced the 2026 contribution limits for 401(k)s and IRAs, offering a slight reprieve in the face of persistent inflation. For 401(k)s, the limit jumps to $24,500, a $1,000 increase from 2025. IRA limits will see a $500 bump, reaching $7,500. On the surface, this looks like good news for retirement savers. But let's dig into the numbers.

The Inflationary Tightrope

The IRS adjusts these limits annually, using the Consumer Price Index (CPI) for the 12-month period ending in September as its yardstick. The most recent CPI showed inflation at 3%, a percentage point above the Federal Reserve’s target. While that's a moderation from the 9.1% peak in 2022, it's still elevated. The question is, are these increased contribution limits truly keeping pace with the erosion of purchasing power?

Consider this: a $1,000 increase in the 401(k) limit sounds substantial until you factor in the real cost of goods and services. That extra grand might cover a few more months of groceries, but it’s not going to radically alter anyone’s retirement trajectory. It’s more like a symbolic gesture than a game-changing advantage. The "super catch-up" provision, allowing those aged 60-63 to contribute up to $11,250, remains unchanged for 2026.

Workers age 50 and up get a boost as well. The maximum contribution amount rises to $8,000, up from $7,500 this year. This means these workers will be able to contribute a total of $32,500 in 2026.

The Devil's in the SECURE 2.0 Details

The SECURE 2.0 Act, implemented last year, introduced the "super catch-up" provision. Workers aged 60 to 63 can contribute up to $11,250, but this figure remains static for 2026. The IRA catch-up contribution limit for those 50 and older sees a modest increase to $1,100, up from $1,000. These adjustments are welcome, but they’re incremental. You can read more about the changes in contribution limits in this New IRS Rules for 2026 Will Allow You to Contribute More to Your 401(k) and IRA article.

Here's where my analysis suggests a potential blind spot. The income eligibility ranges for IRAs and the Saver’s Credit also increased for 2025. For single taxpayers in a workplace plan, the phase-out range for traditional IRAs will increase to between $81,000 and $91,000, up from between $79,000 and $89,000 for 2025. For married couples, the amount will increase to between $129,000 and $149,000, up from between $126,000 and $146,000 for 2025. But are these phase-out ranges keeping pace with wage inflation? If incomes are rising faster than the phase-out thresholds, then the benefit of contributing to a traditional IRA diminishes for a larger segment of the population. This is the part of the report that I find genuinely puzzling.

The fact that the IRS is making these adjustments at all suggests they're at least aware of the inflationary pressures squeezing retirement savers. But is it enough? The increases seem almost calibrated to be just barely adequate, enough to avoid widespread criticism but not enough to truly empower individuals to build substantial retirement nest eggs.

A Statistical Band-Aid on a Financial Hemorrhage

Ultimately, the 2026 contribution limit increases are a statistical band-aid on a financial hemorrhage. They're a necessary adjustment, but they don't fundamentally alter the challenges faced by those trying to save for retirement in an inflationary environment.

Tags: 401k contribution limits 2026

IRS Direct Deposit: November 2025 Stimulus... Seriously?

Next PostAI: How Long Before a GPU Depreciates?

Related Articles