MP Materials Stock: The Nvidia Comparison and What to Do Now

Title: MP Materials: Next Nvidia or Fool's Gold?

The market loves a good comparison. And the recent buzz around MP Materials (MP) – the rare earth mining outfit – being the "next Nvidia" is certainly generating clicks. Shares have jumped 250% this year, fueled by rising demand and the allure of a domestic supply chain for critical minerals. But can a mining company really mirror the trajectory of a tech behemoth like Nvidia? Let’s dig into the numbers and see if this comparison holds water, or if it’s just wishful thinking.

The Scarcity Factor

Both MP Materials and Nvidia benefit from scarcity, that much is true. Nvidia's scarcity stems from its dominance in AI chip design. Few can compete with their processing power, leading to high demand and soaring revenue. MP Materials, on the other hand, has a more literal scarcity: the Mountain Pass mine. It's one of the only scaled rare earth sources in the U.S. (and that's not nothing). The fact that China controls so much of the rare earth market only amplifies this advantage for MP.

That said, it's a different kind of scarcity. Nvidia's scarcity is based on intellectual property and technological advancement. MP's is based on geology and geopolitical dynamics. One is arguably more defensible than the other. After all, new mines can be discovered, and geopolitical winds can change.

The Trump administration's $400 million investment underscores the strategic importance of MP's role in securing U.S. rare earth independence. This isn't just about profit; it's about national security. The question is whether that political tailwind can translate into sustainable profitability.

Margins and Reality

Here’s where the Nvidia comparison starts to break down. Nvidia is a high-margin tech company riding multiple trends. MP Materials is a mining company with heavy capital expenditures and vulnerability to commodity cycles. This difference is starkly reflected in their free cash flow.

The article mentions MP is still building its second magnet factory (the "10X Facility"), which should boost revenue and free cash flow once complete. That's the promise, anyway. Scaling magnet production is a significant execution risk (and execution risks are always underestimated in bullish projections). And even with the new factory, can MP Materials achieve the kind of margins that justify its current valuation? (That's the multi-billion dollar question, isn't it?)

To match Nvidia's valuation, MP would need to climb roughly 44,900% from its current price. That's a tall order, even in today's frothy market.

Drilling Down on the Q3 Numbers

MP Materials announced Q3 2025 results on November 6th, and the numbers paint a mixed picture. Revenues declined 15% year-over-year to $53.6 million, but they still surpassed estimates. MP Stock Gains 13% Post Q3 Earnings Beat: Time to Buy, Sell or Hold? They produced a record amount of neodymium and praseodymium (NdPr) – the key rare earth elements – and logged the second-highest quarterly output of rare earth oxides (REO). Production of NdPr jumped 51% year-over-year to 721 metric tons. Sales volumes also rose 30% to 525 metric tons.

But here's the discrepancy: The Materials segment's revenues declined 50% year-over-year to $31.6 million. This was because a 61% increase in NdPr revenue was offset by the absence of rare earth concentrates sales. In other words, they're shifting away from selling raw materials and focusing on higher-value separated products. The Magnetics segment generated $21.9 million in revenue and $9.48 million in adjusted EBITDA. Initial commercial magnet production is still on track for year-end.

And this is the part of the report that I find genuinely puzzling. They are producing more of the good stuff (NdPr) but making less money in the "Materials" segment. Are they holding inventory? Is there a lag in pricing? It's not entirely clear from the filings.

Advanced projects and development expenses spiked by 828% (or $17 million), which included transaction costs related to the Department of War agreements and securing financing. All this investment is expected to lead to higher costs this year, and likely a full-year loss.

Reality Check: The Hype Train Needs Brakes

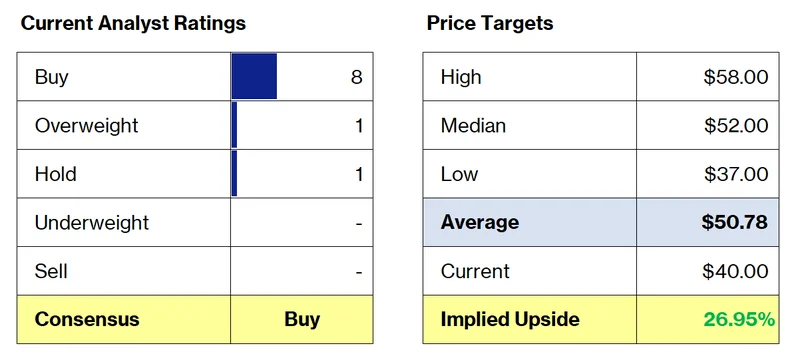

MP Materials has a unique position in the U.S. supply chain, and its efforts to ramp up operations and partnerships with Apple and the DoD are promising. But the current valuation feels stretched, especially considering the expected loss this year. Investors already holding MP shares might want to ride out the long-term potential. But new investors should wait for a better entry point. The comparison to Nvidia is a tempting narrative, but it overlooks the fundamental differences between a high-margin tech company and a capital-intensive mining operation.

Tags: mp materials stock

The ABAT Stock Surge: Why It's Rising, Its Future Potential, and the Community Buzz

Next PostWilliam Levy's 'Bajo Un Volcán' Debuts on ViX: What Happened?

Related Articles